What are cryptocurrency taxes?

Cryptocurrency taxes is money that you pay to the government on the profits that you make when trading or holding cryptocurrencies.

They’re applicable in most countries around the world, and they’re usually charged at the regular capital gains rate that you’d pay on other investments.

However, a few countries have tax rules for cryptocurrencies.

Some nations charge more for cryptocurrency profits, and some will allow you to cut your tax bill down.

Due to the fact that cryptocurrency is still relatively new, there are not many crypto tax laws around.

This is both good and bad for you as a crypto trader.

You might be able to score a nice break if your country hasn’t done anything about cryptocurrency.

On the other hand, you could end up forking out a fair deal of your profits to the tax man.

It all depends on where you live.

So, let’s not waste any time and run you through the world of crypto taxes.

Do I have to pay tax on my cryptocurrency profits?

This will be the case for the vast majority of crypto traders out there, and sadly the tax man will know if you’ve been naughty or nice.

As a general rules of thumb, if capital gains tax exists, then you will need to pay taxes.

In countries with no specific crypto tax rules, capital gains rates are used.

This does have its advantages though.

Under capital gains tax rules, you can also claim back capital losses.

So, let’s say you made $10,000 profit from Bitcoin, but you lost $5,000 on another trade, you can deduct the loss from the profit, leaving you to pay tax on the $5,000 profit.

You can also deduct trading fees.

You will add the cost of the fee into the cost basis of acquisition and deduce the fees from the proceeds of the sale of a particular cryptocurrency.

If you buy $10,000 of Bitcoin, but you pay $250 in fees, you will report your acquisition price of Bitcoin as $10,250.

Then, if you go on to sell on your Bitcoin when it’s worth $11,000 and you pay another $250 in fees, you deduct that fee from the profit.

So, you’ll only have to pay tax on the $500 profit that you made.

While tax is a pain, there are plenty of rules that allow you to bring the ball into your court and get deductions.

Learn the taxable events

When it comes to declaring your crypto tax, you need to be aware of the exact profit or loss on each transaction.

That’s where taxable events come in to play.

Taxable events are when you do something with a cryptocurrency that means you are required to pay taxes.

However, this isn’t on every type of transaction, so it’s worth learning the difference so that you don’t over or under pay.

Non-taxable events

It’s probably simpler to run you through the non-taxable events.

This is because everything else is a taxable event.

So rather than learning a massive list, you can learn a small list of events that are not taxable.

Cryptocurrency is widely taxed as property, which means that you must report gains or losses when you sell it.

But, if you move cryptocurrency to an exchange, this is not considered a taxable event.

You will only pay the tax when you execute the trade and complete the transaction.

If you gift crypto to someone, this is also not a taxable event.

This line gets a bit blurry as proving which transactions are gifts and which are not can be tricky.

If anything, this gives the tax man a disadvantage as this can be exploited.

Large gifts may trigger other tax requirements, especially if one party of the transaction dies within 365 days of it being completed.

Finally, you don’t pay tax when you buy cryptocurrency.

This is used to determine your cost basis

That brings us on to our next part – picking your cost basis method.

Picking the cost basis method

Every country that require you to pay tax on your cryptocurrency profits will have a selection of cost basis methods to pick from.

There are generally 6 cost basis methods that you can use.

They all generally work out at around the same value anyway, so pick the one that is easiest for you to work with.

Once you’ve picked a cost basis method, it’s best that you stick with this long-term.

Some tax jurisdictions may not accept all of these cost basis methods, so do triple check before submitting your tax return.

The 6 common cost basis methods are:

- First in first out

- Last in first out

- Highest cost

- Lowest cost

- Average cost

- Specific identification

The most commonly accepted are first in first out and specific identification.

First in first out works with the concept that the first transaction in will be the first out.

So, let’s say you buy 1 Bitcoin for $1,000 and then a week later you buy another 1 Bitcoin for $2,000.

You then sell 1 Bitcoin when the value per Bitcoin is $10,000.

The tax in this instance would be calculated on the first Bitcoin that you bought.

If you sold 2 Bitcoin at $10,000, you’d work it out by adding the cost price and deducting that from the overall profit.

So, the math would be $20,000 – ($1,000 + $2,000) = $17,000.

You’d then pay tax on the $17,000 profit.

Specific identification is a bit harder to pull off and isn’t possible in all cases.

The idea behind this is that you will note the exact cryptocurrency that you own and the date that you bought it.

You then prove that you’re selling this specific cryptocurrency, rather than cryptocurrency that you bought before.

This does not work when cryptocurrencies are pooled together, like at an exchange.

Your best bet to pull this off is to segregate cryptocurrencies in different wallets based on the price you bought at.

It’s a lot more work, but it allows you to offload higher cost basis cryptocurrency which is advantageous to your tax plans.

You’re more likely to make a loss on this Bitcoin, which will help reduce your tax bill.

Where does cryptocurrency tax exist?

Governments don’t like to miss out on an opportunity to rummage through your pockets and take some extra money.

At the end of the day, it’s more funds in their pockets.

As a result, taxes are almost universal, and you’ll have to pay them on your cryptocurrency gains.

When it comes to cryptocurrencies, some countries are more organized than others.

There are a lot of countries that don’t specify any tax rules for cryptocurrency.

In these cases, it’s best to go with capital gains rates as the benchmark for your calculations.

Alternatively, you can speak to an accountant in your area that is more knowledgeable based on the requirements and needs for your specific country.

Calculating crypto tax can be simple

Calculating taxes isn’t easy at the best of times, let alone when there’s crypto involved.

So, we’re going to share a life hack that will make it easier than ever before for you to record and report your crypto taxes.

Crypto tax apps!

Crypto tax apps will make your life incredibly easy.

All you have to do is download the app and share your crypto exchange API keys with it and let it know all of the wallets that you control.

The app will then track these wallets and take note of every trade, purchase or movement you make in the crypto world.

It’ll then work out the taxes that you owe for your country, and some will even help you fill out your tax return forms.

Some people are uncomfortable sharing API keys and doxing their wallets with these apps, and that’s fine.

There’s no pressure to use them and you don’t have to – it’s totally optional.

However, they do make your life a lot simpler, and they allow you to keep a perfect record.

It’s incredibly easy to miss off a few transactions if you track them all manually.

There are quite a few crypto tax apps out there, and some are a little better than others.

But at the end of the day, a lot comes down to personal preferences.

How to pick the best crypto accounting software

Before you dive into a crypto tax app, you need to take a few factors into account.

The most important consideration is your country.

If the crypto tax app doesn’t support your country, then it won’t be able to calculate your taxes properly.

Most apps and software will cover larger countries, so you should have a good selection to pick from.

Next up is looking at apps that cater to your needs.

Are you a casual trader or do you trade every day?

For those of you that are real power traders, then you’ll need a beefier software that can keep up with you.

Generally speaking, the more you trade, the more it costs to use these apps and software.

Finally, if you’re a crypto trader that likes to get down and dirty with everything in the crypto world, you might need the help of a certified tax professional.

So, if you’re into DeFi, ICOs, IEOs, airdrops and more, then you should skip crypto tax apps and get yourself a certified accountant (CPA).

This will save you a lot of time, hassle and trouble, as most crypto tax apps won’t support all of the assets that you’re involved with.

The best crypto tax apps are:

Some of these apps are paid, so prepare to fork out a couple hundred Euros or more if you’re an active trader.

While that might seem like a steep price, it could save you a fortune down the line.

You could be legible for a tax refund, if you do your crypto taxes right, which could be worth thousands.

Some will offer a free package or a free trial, so test them out to see which is best for you.

Can I get tax deductions for my cryptocurrency?

If you’re paying taxes on your cryptocurrency profits, then you could be in line for some deductions.

Most countries treat crypto as an asset, meaning that you’re taxed in the form of capital gains.

If you’re a more frequent trader and it forms your income, it will be taxed at income tax rates.

But, both rates entitle you to some types of deductions, which is great news.

Some countries have laws that say gambling isn’t taxed at a player level, with the operators paying the taxes.

That means that in these countries you don’t need to pay any tax on crypto gambling income.

So if you’re in a country with this tax rule, win crypto from a gambling site and make a tidy profit, you don’t need to pay taxes.

Capital gains

When you pay crypto tax at capital gains rates, you’ll also be allowed to deduct your losses.

This is known as capital loss.

Let’s say that you buy 1 Bitcoin at $10,000, but you sell it for $5,000.

You’ll be able to deduct $5,000 from your overall crypto profit.

You can only deduct capital losses up to the value of your profits.

This is why using specific ID to pay your taxes can be advantageous.

If you can sell off your higher cost basis crypto at a loss, you can offset your tax bill advantageously.

You will also be able to deduct the fees involved when buying, selling and trading cryptocurrency.

You simply add the fees to your cost basis and remove them from your overall profit.

Income tax

If you’re trading cryptocurrency every day or crypto is a source of income, then you’ll pay your income tax rates on your crypto.

Under these circumstances, you can still apply the logic of cost basis.

This will mean that you made less income because of a loss, so you just report it as less income.

Some jurisdictions will let you deduct trading fees as a business expense.

But not all allow for this, so triple check as it’s a nice perk to use.

Are there any countries with discounts or reduced tax rates on cryptocurrency?

Some countries have specific crypto tax laws in place, and many of them are favorable to you as a trader.

A handful of countries will reduce your payable tax bill to €0 if you hold your cryptocurrency for more than a year.

Australia, Germany, and Malta all do this, making these popular jurisdictions for long-term hodlers.

This is becoming a trend and we’ll likely see more countries follow suit as they implement and refine their crypto tax legislation.

All 3 of these countries will tax you at regular rates if you trade cryptocurrency and sell it before you hit the 1-year mark.

So there’s definitely an incentive to trade and hold for the long-term.

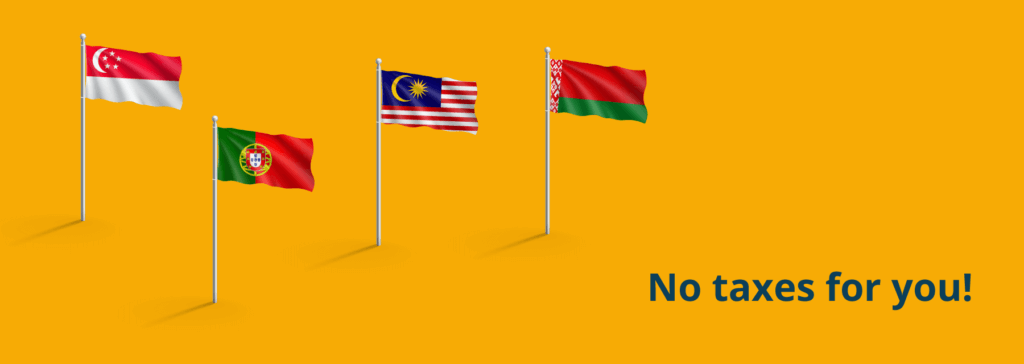

Which countries don’t tax cryptocurrency gains?

If you’re looking to pay $0 tax on your cryptocurrency, then you might need to look at relocating to one of these countries.

There are a handful of countries that do not have capital gains tax regimes and won’t tax you at income tax rates.

These are the ideal places to call home if you’re heavily into crypto or it forms one of your largest sources of income.

Generally speaking, you need to reside in one of these countries for more than 182 days to be considered a tax resident.

Switzerland

Switzerland is one of the most crypto-friendly countries in the world, complete with its own crypto valley.

If you’re a qualified professional trader, then your crypto tax will be taxed at regular income tax rates.

But if you’re a regular Joe, you don’t need to pay a cent.

Mining is down as self-employed income and is taxed as such.

Belarus

In 2018, Belarus made cryptocurrency activities exempt from certain taxes.

Mining and investing in crypto from Belarus are activities that are exempt from tax until 2023 under these new rules.

When 2023 rolls around, Belarus will consider whether to extend the tax-free period or to roll out sweeping tax reforms.

We’ll keep you updated on that.

Malaysia

Malaysia doesn’t have capital gains taxes, meaning you don’t need to pay taxes on your crypto investments.

However, the government is known for its ever-changing stance towards crypto.

So if you’re mining in Malaysia, make sure that you keep up to date with the local rules and regulations to keep your mining rigs out the way of a heavy roller!

Malaysia has been rumored to be planning a sweeping tax reform for its cryptocurrency taxes, but we’ve yet to see anything materialize.

If you’re looking for a long-term crypto haven, Malaysia might not make a good choice.

Portugal

Portugal passed legislation in 2018 that exempts VAT and personal income tax on crypto.

This means that as long as you’re not operating as a business, then you don’t need to pay crypto taxes.

Portugal is one of the stand-out location in this list of crypto tax-free jurisdictions, with a moderate cost of living.

Singapore

Akin to Malaysia, Singapore doesn’t have any capital gains laws.

This means that cryptocurrency earnings are tax free.

Businesses and people operating as businesses will have to pay taxes at the regular income tax rates, but this won’t impact your average Joe.

Singapore isn’t planning to reform these rules any time soon, making it a popular destination for exchanges and crypto-focused people.

Will you be paying your crypto taxes?

Taxes on your crypto profits do need to be paid, whether you like it or not.

Exchanges are beginning to work with tax agencies, meaning that they know what you make.

If you’re caught out, you can land yourself in hot water, resulting in a fine and even jail time.

Using a crypto tax app is the simplest way to stay on top of your tax obligations.

If you’re a more advanced crypto trader, then it’s best to ask a professional certified accountant for advice.

Remember, these people and apps could save you money.

Not paying tax is a crime, so please don’t do that!